How to apply for a BTO

Getting a Build To Order (BTO) flat in Singapore can be a tedious process. There are a bunch of choices to be made, documents you need to submit, and payments that need to be done, and it can all get very confusing – so here’s a seven-step break down of the process to guide you through the journey:

Before reading this article, check out our guide on what you need to settle before applying for a BTO here.

1. Check out the quarterly flat sales launch

BTO flats are released four times a year, typically around February, May, August and November. As a head’s up, HDB will announce the launch six months prior, with a preview of upcoming launch details – including a map of the area and types of units available. You can use this preview time to decide if you’d like to apply for the flats that are open for sale.

The number of vacancies available varies between launches, but there are usually several locations up for grabs, spread across both mature and non-mature estates. You can check out the upcoming sales launches here.

2. Apply for a housing grant

To ease the financial burden of purchasing a house, you can apply for a HDB grant, also known as the CPF housing grant.

As of 11 September 2019, the Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG) have been replaced with the new Enhanced CPF Housing Grant (EHG).

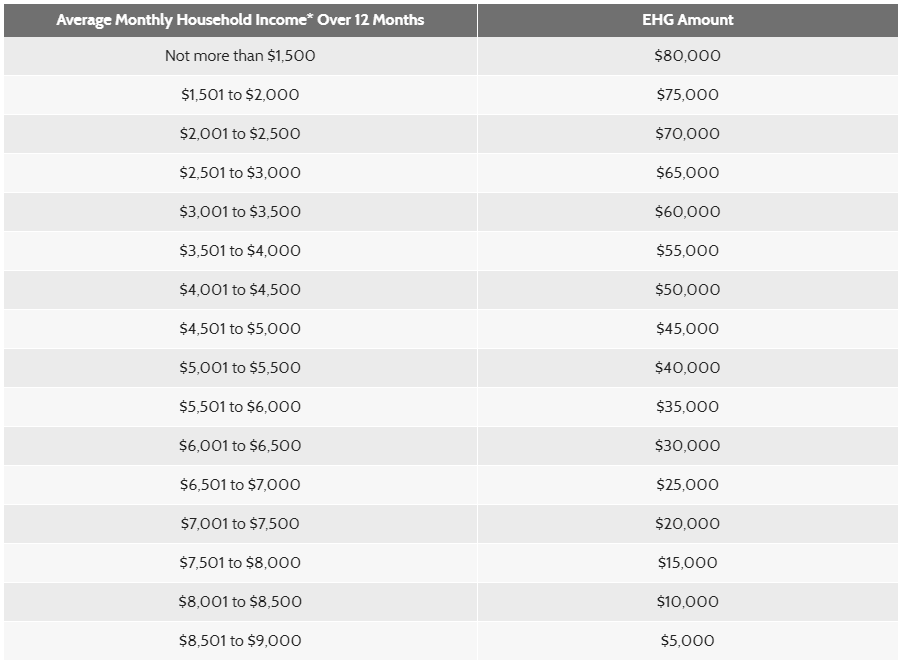

The grant amount ranges from $5,000 to $80,000, and how much you’re able to get depends on your average gross monthly household income for the 12 months prior to you submitting your flat application. The lower your income, the higher the grant.

EHG amount according to income

Image credit: HDB

The EHG is applicable to those with a household income ceiling of $9,000 per month, for first-timer applicants. If granted, the money will be credited into your CPF Ordinary Account and deducted from there to pay for your flat.

3. Explore loan options – HDB or bank loans

An average Singaporean doesn’t have several hundred thousand dollars sitting in their bank, so to pay for your BTO, you can either take up a HDB housing loan or a bank loan. Knowing the estimated housing loan you’ll be able to get will be able to help you with determining what kind of HDB to purchase.

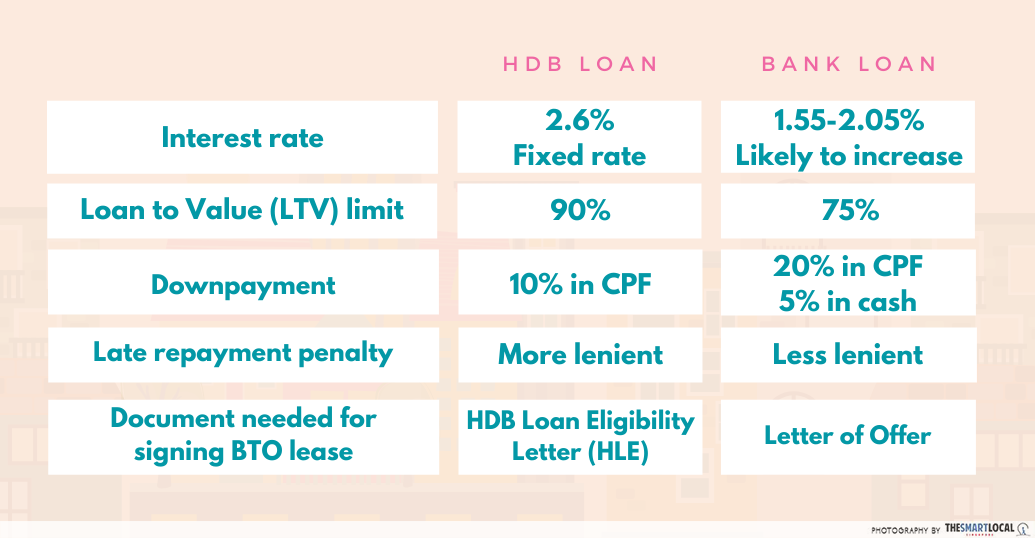

Below are the main differences between a HDB loan and bank loan:

Generally, most people prefer HDB loans to bank loans as it’s the more stable option. To qualify, you’ll need to check off the following:

- At least one buyer is a Singapore Citizen

- Average gross monthly household income does not exceed $14,000 for families, $21,000 for extended families and $7,000 for singles. (Updated on 11 Sep 2019)

- No ownership of private residential properties 30 months before application for HDB Loan Eligibility (HLE) letter

The loan amount offered will be determined by your age, monthly income and financial situation.

If you’re opting for a bank loan, make sure to go to a bank that’s regulated by the Monetary Authority of Singapore. Loan amounts vary depending on which bank you head to.

4. Submit your application

Commonly known as balloting, the application for BTO is the next step to securing your home. There is only a one week window for application each round. To ensure you don’t miss it, sign up for email and SMS notifications.

During the submission, you’ll be asked to fill in particulars such as your monthly household income. Applications can be submitted on HDB InfoWEB.

For those who are in more urgent need of getting a HDB flat, or are planning to stay near their parents, there are Priority Schemes that’ll help you improve your chances of getting a queue number.

Below are some Priority Schemes and who they’re applicable for:

- Parenthood Priority Scheme (PPS) – First timer married couples with children

- Multi-Generation Priority Scheme (MGPS) – Parents and married children applying for houses in the same estate together.

- Married Child Priority Scheme (MCPS) – Married couples who are applying for a flat within 2KM radius or in the same town as their parents

Couples do not have to be legally married by Registry of Marriage (ROM), during the time of application, but you’ll have to submit the marriage certificate within three months of collecting your keys.

Payment required: $10

5. Balloting outcome

About three weeks after the application window closes, you’ll receive the balloting outcome. This results are computer-generated and completely selected at random, so however early or late you apply during the one-week window will not affect your chances.

If you’ve made it through, congratulations, you’re past the balloting gate! Successful applicants will get a queue number which determines how early you get to call dibs on your preferred flat unit.

6. Selecting a unit

In order of queue number, applicants will be called down to meet a HDB officer at Toa Payoh HDB Hub one-two weeks after the release of balloting results. This HDB officer will guide you throughout the rest of your BTO journey.

During this appointment, there are 2 main objectives:

- Picking your preferred unit – common preferences are units on higher floors and blocks that are nearer to the MRT.

- Submission of relevant documents – Prepare your identity card or passport, HDB Loan Eligibility Letter and income documents. If you’ve qualified under certain priority schemes, extra documents need to be submitted.

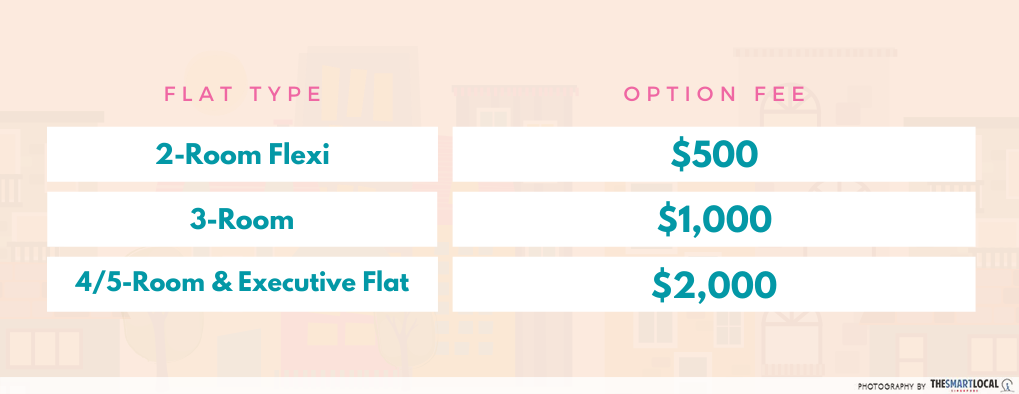

Payment required: Option Fee (by NETS), see table below for details.

7. Sign Agreement for Lease

Within four months, you can head down to sign the Agreement for Lease.

At this stage, you have more or less secured your BTO and it’s time to get down to the paperwork. This includes submitting the Letter of Offer from any bank loans or HLE letter from any HDB loans.

The ownership status of the flat has to be decided at this point as well: Would you prefer to split the share equally, and hold equal rights (Joint-Tenancy) or have the shares clearly divided, unequally (Tenancy-In-Common).

Payment required:

- Stamp duties – IRAS’ stamp duty calculator

- Legal fees – HDB’s legal fee calculator

- Caveat registration fee – $64.45

- Conveyancing fee – $20 onwards

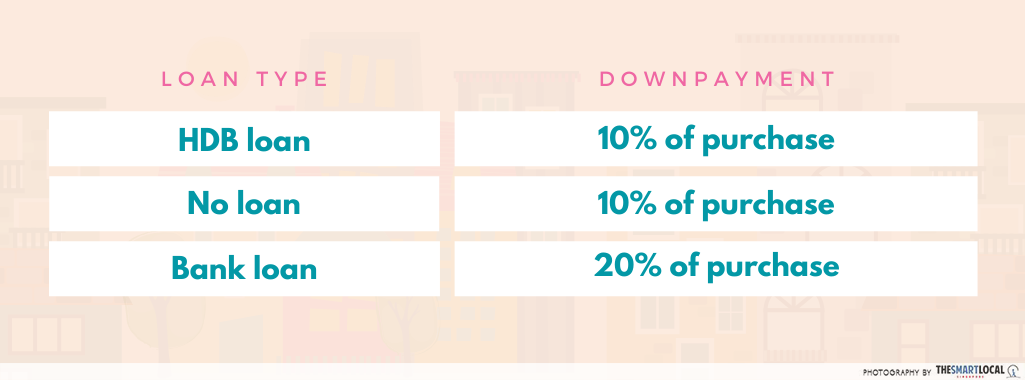

- Downpayment (see details in table below)

Between this and the final step, you can expect to wait an average of 3 years for the construction of your BTO.

8. Collect your keys

After trials, tribulations and a lot of time, you’ve reached the final step of attaining a BTO. Once HDB notifies you that your keys are ready for collection, you’ll be the proud owner of a spanking new house to call home!

Post-BTO purchase: Getting insurance and home protection

As with all valuable things, your BTO should be insured to ensure that you’re protected in case anything goes south. Below are some of the main insurance policies and protection schemes you need to look out for:

- HDB Fire Insurance – You’re automatically signed up for this when you purchase your HDB. It only insures the infrastructure of the building.

- Home Insurance – Protects your home, renovation and its contents against common mishaps like burglary and damage to water pipes. It’s priced from about $35/year, and common providers include from NTUC, FWD and Aviva.

- Home Protection Scheme (HPS) – Compulsory if you are using your CPF savings to pay for your housing loan instalments. It protects you and your family from losing your HDB in the event of death, terminal illness or total permanent disability. HPS premium is calculated based on factors like outstanding housing loan on your flat, loan repayment period and percentage coverage*. You can estimate the cost here.

Guide to applying for a BTO flat

From here on, it’s down to renovating your BTO and making it a space you’d like to stay in for years to come. Check out our renovation-related articles here:

- HDB renovation tips

- Pantone colour palettes for themed homes

- Affordable HDB transformations

- Muji-themed home decor tips

Photography by Pichan Cruz.

Originally published on 19th November 2019. Last updated